30+ Amortization chart real estate

Need a full-featured desktop calculator program for real estate. Based on the details provided in the amortization calculator above.

Areinvestorday2016

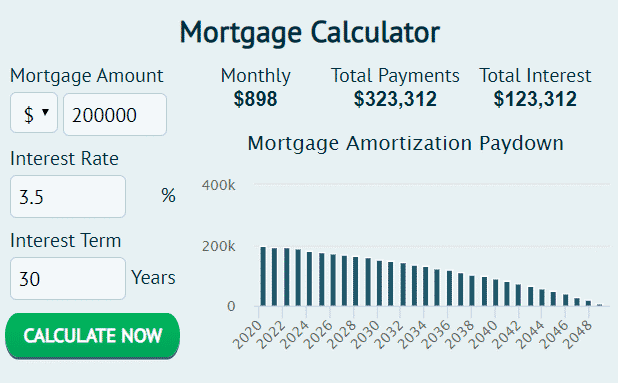

This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments.

. This quizworksheet will determine what you know about key points like a monthly payment for 30 years at 5 interest and the process of re-calculating a loan when the interest rate is changed. 30-Year Mortgage Amortization Schedule by Month. 392 rows 30 Year Fixed Rate Mortgage Loan Calculator This calculator will compute a.

Ad Leading Software for Amortization. Now if we took the same example from above but stretched out your repayment plan to a 30-year mortgage your. LOAN AMORTIZATION SCHEDULE.

It also determines out how much of your repayments will go towards. California mortgage rates today are 3 basis points lower than the national average rate. 30360 is calculated by taking the annual interest rate proposed in the loan 4 and dividing it by 360 to get the daily interest rate 4360.

Learn how amortization works in real estate for. The rate on the 30-year fixed mortgage slipped to 499 from 53 the week prior according to Freddie Mac. Sales of existing US.

The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance. What is the monthly mortgage payment PI for a 250000 30-year loan at 85. Amortization Chart Monthly Payment Per 1000 of Mortgage Rate Interest Only 10 Year 15 Year 20 Year 25 Year 30 Year 40 Year 2000 016667 920135 643509 505883 423854 369619.

Creating Real Estate Investment and Development Software since 1981. From stock market news to jobs and real estate it can all be found here. Amortization is a gradual reduction of a loan debt through periodic installment payments of principal and interest calculated to pay off the debt at the end of a fixed period.

The current average 30-year fixed mortgage rate in California remained stable at 523. To solve this problem we first look at the amortization table to find that the. Amortization is a way to pay off debt in equal installments that include varying amounts of interest and principal payments over the life of the loan.

This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. Homes rose in June to an eight-year high spurred on by rising interest rates and higher demand according to the National Association of Realtors.

Cade Ex991 149 Pptx Htm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

2

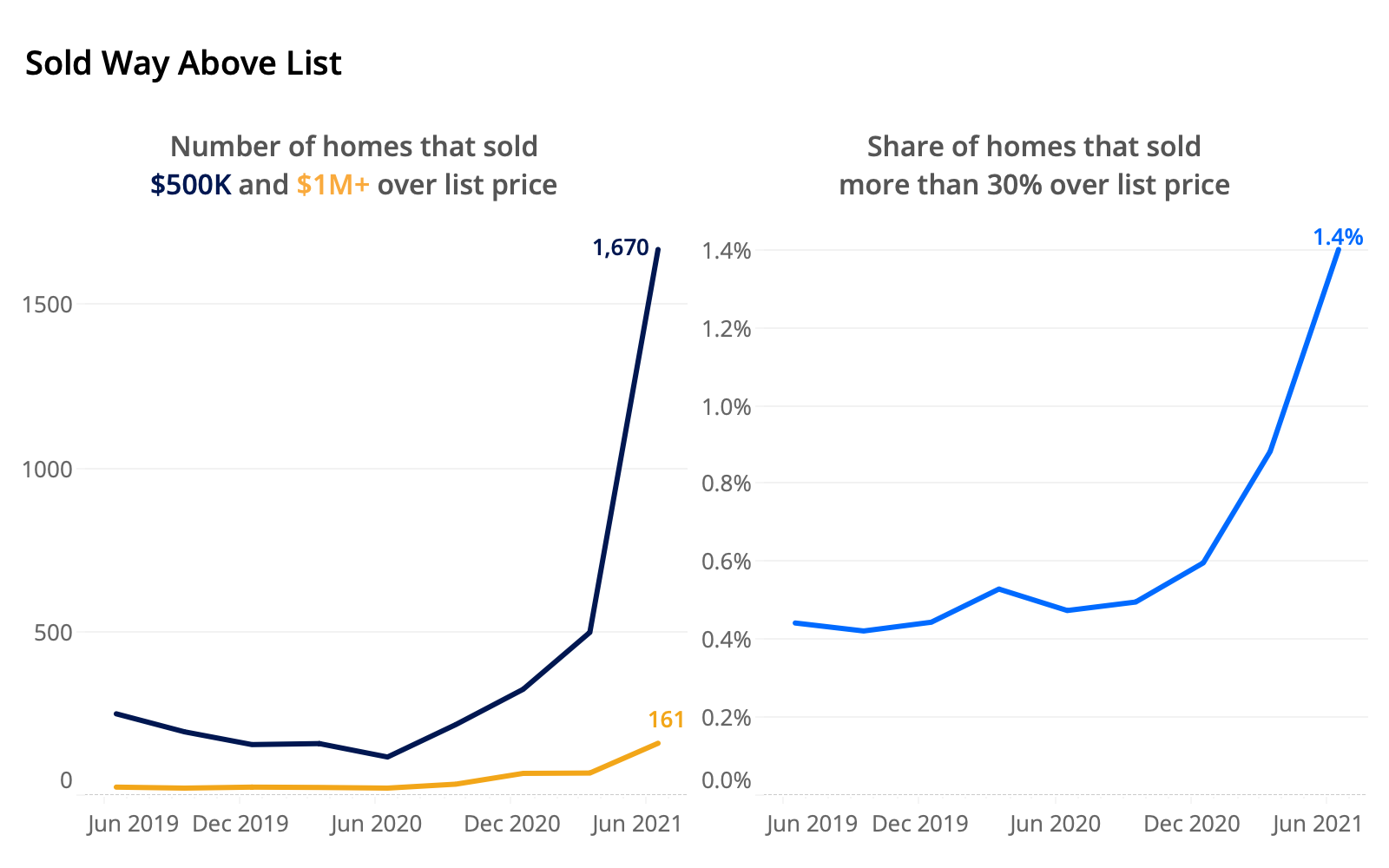

Share Of Homes Sold Way Over List Doubles Zillow Research

Real Estate Powerpoint Template 30 Total Slides Powerpoint Presentation Design Powerpoint Design Powerpoint Design Templates

Insights Eaton Vance

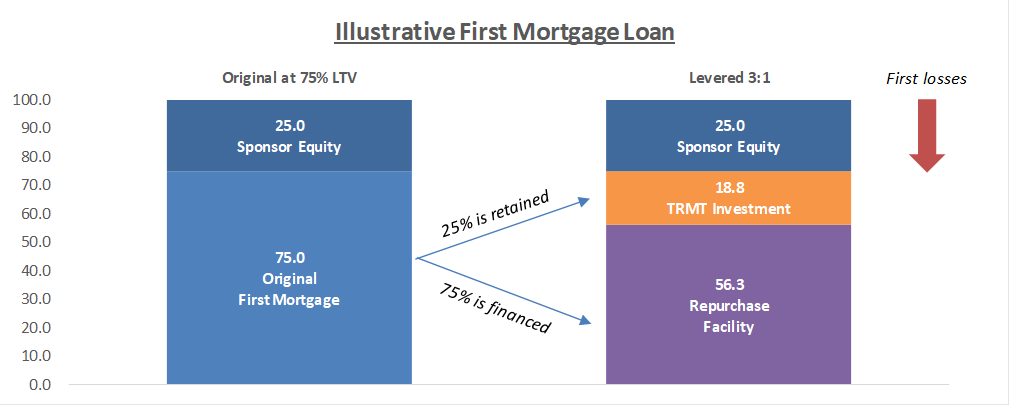

Tremont Mortgage Trust A Microcap Reit Turnaround That Offers A 16 Future Dividend Yield Or 70 Upside Nasdaq Sevn Seeking Alpha

Commercial Real Estate Financing Sales Dallas Texas Northmarq

I Have Presently Have A 4 125 30 Year Mortgage And I Was Thinking About Going Into A 15 Year Mortgage At Roughtly 3 0 I Wanted To Hear Your Toughts For The

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Sec Filing Patria Investments Limited

Real Estate Calculators Mortgage Rent Vs Buy Affordability More